Car Loan Monthly Payment Formula

There are special types of loans issued by banks or private lenders that may use their own methods and formulas such as loans with the entire principals due at the end in balloon payments.

Car loan monthly payment formula. The pv or present value portion of the loan payment formula uses the original loan amount. As long as you know your loan factors the calculator will work. P principal amount on the loan. Justin pritchard cfp is a fee only advisor in colorado.

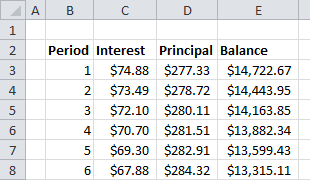

For instance you can use excel to calculate car loan transactions and payment amounts as well as the total interest paid over the life of a loan. If you plan on a 60 month loan at 6 percent you will pay about 20 per month per 1000 that you borrow. Share pin email richard goergphotographers choice rfgetty images by. R monthly interest rate in decimal form yearly interest rate100 12.

Technically you can use car loan payment calculators on any of your loans. However if you know your principal length of loan and annual percentage rate you may use this formula. You want to calculate monthly payments not annual payments so youll need the total number of months throughout the life of the loan. Formulas and tools free calculators show how debt works.

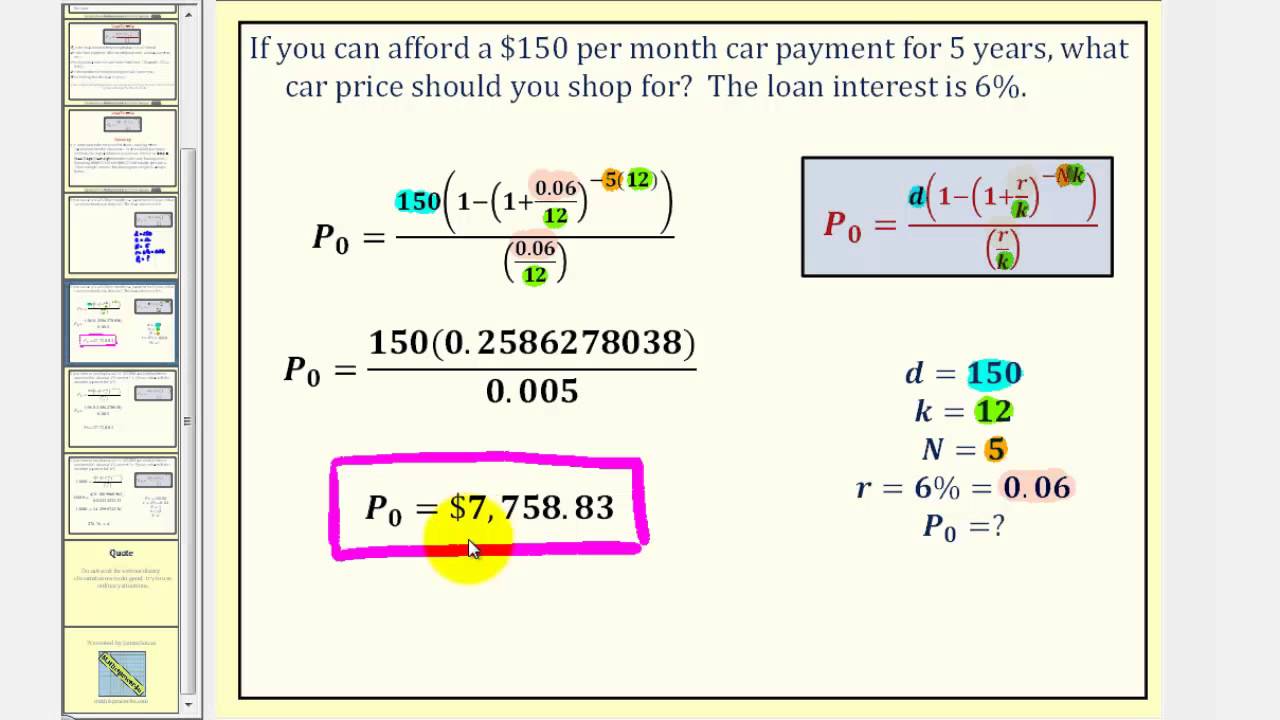

Monthly payment for 5 year auto loan with a principal of. Knowing how much you will pay each month will help. These variables help you plan ways to reduce your debt. The longer your loan the smaller your monthly payment will be but the larger the total amount of interest you will pay over the life of the loan.

This loan payment formula may be used only for standard loans. Buying a car often requires taking out a loan to finance a portion of the costs. Estimate the size of your monthly payment while you are shopping for a car by using a simple rule of thumb. Again these estimates do not factor in your up front costs.

N total of months for the loan years on the loan x 12 example. He covers banking and loans and has nearly two decades of experience writing about personal. It is important to keep the rate per period and number of periods consistent with one another in the formula. C monthly payment.

For example if the loan is for four years then the number of months is 4 12 or 48. To calculate the monthly payment on an auto loan use this car payment formula. In addition you can use excel to compare multiple scenarios in order to make sound financial decisions. If the loan payments are made monthly then the rate per.

The original loan amount is essentially the present value of the future payments on the loan much like the present value of an annuity. To calculate your monthly payment you need to know your loan term the interest rate and the amount you borrowed. Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off.