Used Car Loan Rates 72 Months

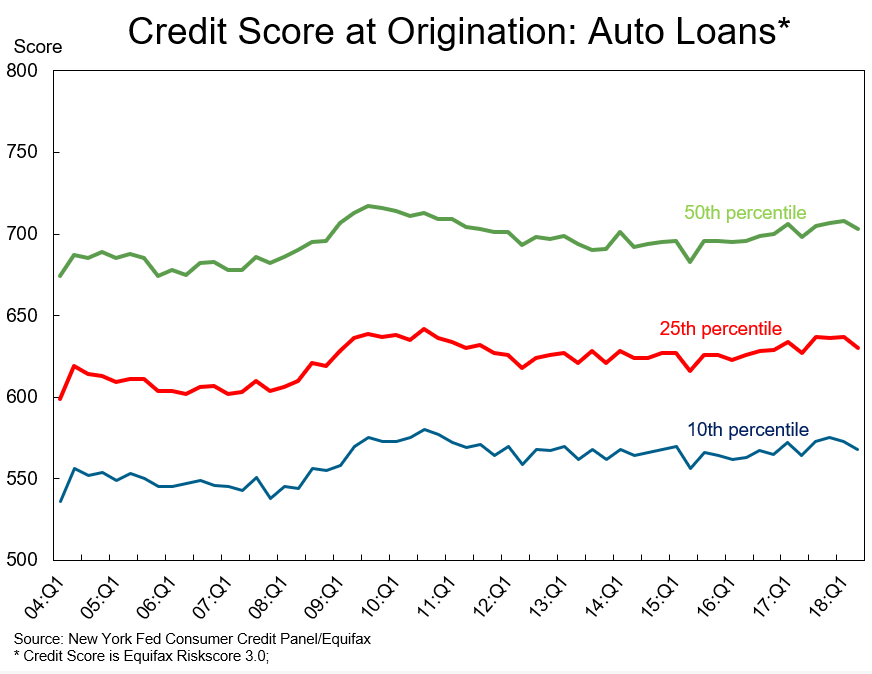

The interest rate on a used car loan depends on your credit score.

Used car loan rates 72 months. You can discuss other terms with your loan officer after your application is submitted. The best auto loans. Bank of america auto loan terms range from 12 to 75 months. This gave the buyer a monthly payment of 556.

Generally the banks and other loan lenders offer a 6 six year plan to the customers. To finance that amount and with those terms lightstream currently. There are options at used car dealerships from shady financial institutions. 6 years or you can say 72 months loan calculator will help you calculate check the emi and the applicable rate of interest on any of the borrowed money for auto loan.

Our online application allows you to select terms of 48 60 or 72 months. 2020 new used car loan rates. Consumers with a credit score over 780 only pay an average of 368. The content of this article is based on the authors opinions and recommendations alone.

The length of your loan will affect the interest rate and how quickly you build equity. You can get a car loan even if your score is very low in the 300 to 500 range. A 72 month used car loan offers advantages that help many borrowers qualify for a car they might not otherwise be able to afford and low monthly payments are chief among those benefits. A 72 month used car loan is expressed by number of months and the payment per month.

But you should avoid those at all costs not only because they have bad terms but also because their interest rates can go beyond the 20 threshold which is kind of crazy. The average length of a car loan ranges from 36 months to 72 months. It means you have to pay back the principal amount with interest in 72 month time duration. When you are seeking any type of loan go into negotiations prepared.

But you will be required to provide a substantial down payment and the interest rate can be as high as 19 which is a lot. But when a car buyer agrees to stretch the loan to 67 to 72 months the average amount financed was 33238 and the interest rate jumped to 66. According to experian the average car loan is just under 32000 with most people choosing a 60 or 72 month auto loan term. It has not been previewed commissioned or otherwise endorsed by any of our network partners.